capital gains tax budget news

Capital gains tax is a tax on the profit when a person sells something which has increased in value. But if you sell a debt mutual fund.

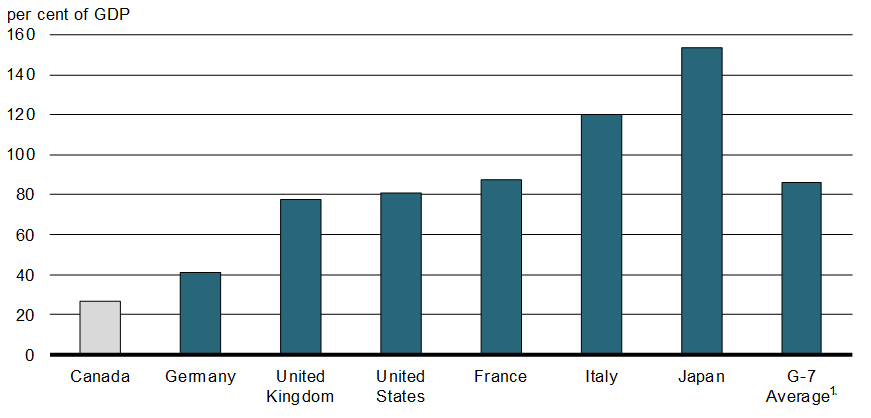

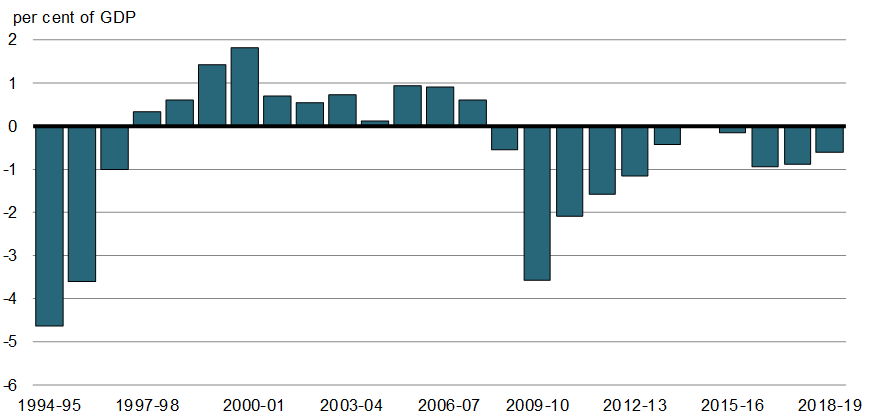

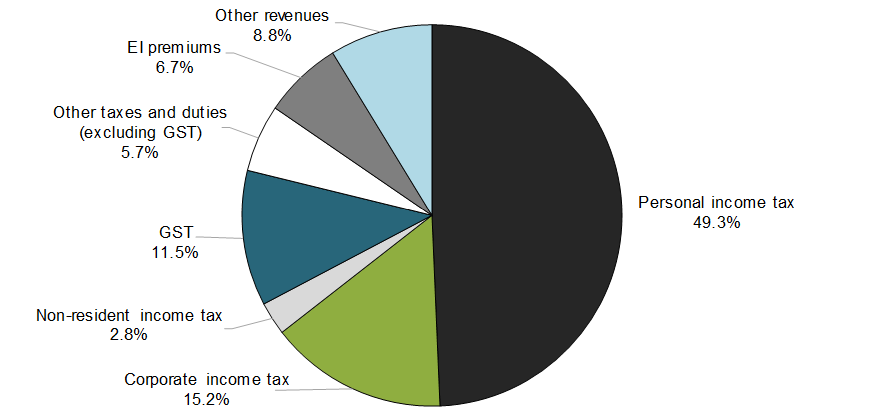

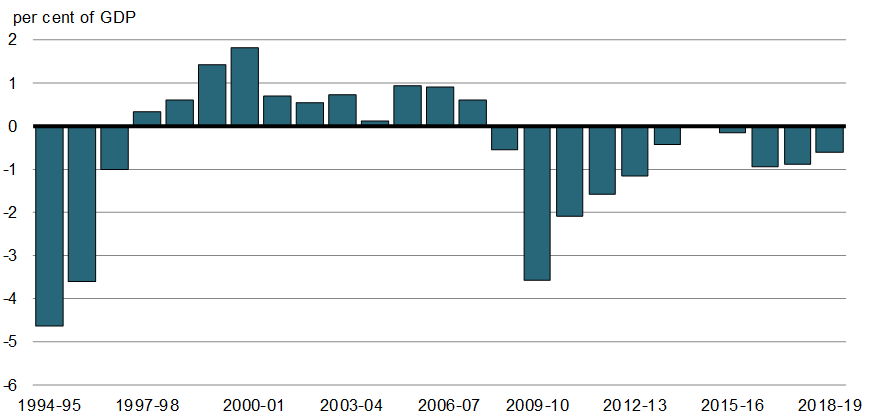

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Tax on capital gains needs to be simplified to make it easier to buy or sell a house and how this Budget can do it.

. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. I Specified Gold Bonds. If you buy a listed bond then you pay long-term capital gains LTCG tax of 10 percent if you hold it for more than 12 months.

62 Gold Bonds 1977 or 7 Gold Bonds 1980 or National Defence Gold. In other words the capital gains arising from the transfer of such urban agricultural lands would not be treated as agricultural income for the purpose of exemption under section 10 1. Trump asked Treasury to look into easing capital gains tax.

By comparison a single investor pays 0 on capital gains if their taxable income is 41675 or less 2022 tax rules. Senate budget debate on tap gas estate capital gains tax relief offered Boston Herald 1739 22-May-22. The scope of capital gains tax was extended to the real estate in 2012.

In addition to the imposition of capital gains tax on the sale of immovable property an adjustable withholding tax will. Govt starts work to bring parity to long-term capital gains tax laws. The CGT annual exempt amount therefore remains frozen at 12300 through to April 2026.

Capital gains made on investments within an ISA are tax-free so use your annual 20000 allowance to protect your wealth from HM Revenue Customs. CAPITAL GAINS TAX rules changed at midnight in news which has been dubbed positive for UK property owners. By Temie Laleye 0749 Thu Oct 28 2021 UPDATED.

0700 Thu Oct 28 2021 UPDATED. Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to leave things as they are with no changes being announced in the Spring Budget. 0947 Thu Oct 28 2021.

Signed into law by Governor Inslee in April 2021 the modest 7 excise tax on annual capital gains above 250000 is exclusively paid by the wealthiest 02 of Washingtonians whose incomes average 26 million per year. Currently returns from listed stocks or shares are taxed at 10 if they are held at least for a year. January 27 2022 1244 PM IST.

Once again no change to CGT rates was announced which actually came as no surprise. Capital gains tax out of firing line in Budget. 0800 Fri Oct 29 2021.

Two years of the Covid-19. The Finance Minister Nirmala Sitharaman announced the capping of the surcharge on the long term capital gains payable on capital assets at 15 percent. Some background on Washington states capital gains tax.

The tax generates over 500 million per year in new revenue that is dedicated to K-12. 08012018 0309 PM EDT. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income.

Get pensions news and advice plus latest money alerts for FREE now. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20.

For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. Basic-rate taxpayers pay 10 on profits and 18 on profits from second properties and higher-rate and additional-rate taxpayers pay 20 and 28 on property. Check out the Enterprise Investment Scheme EIS.

On the other hand similar returns from unlisted shares are taxed at 20 if the holding period is at least two years. 28 Apr 2022 1013 AM IST. Hence such gains would be eligible to tax under section 45.

The Golden State also has a. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. How much tax you pay depends on your level of income.

Most investors pay capital gains taxes at lower tax rates than they would for ordinary income. Investors breathed a sigh of relief as a predicted hike in capital gains tax did not become reality in. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

This is expected to benefit. News Analysis and Opinion from POLITICO. Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains.

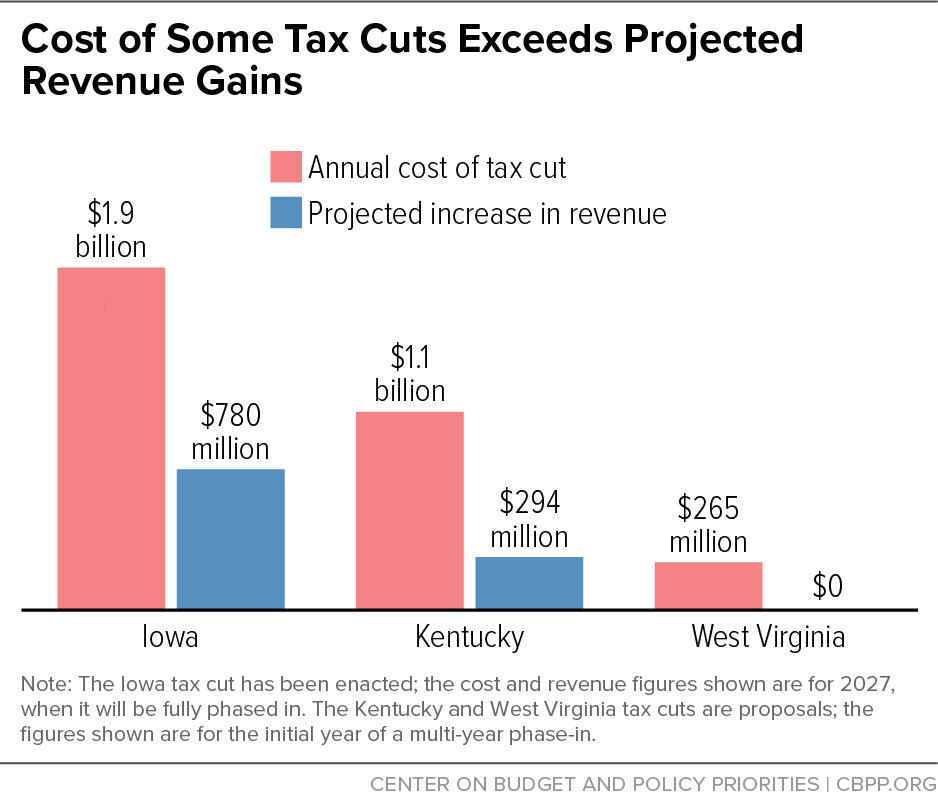

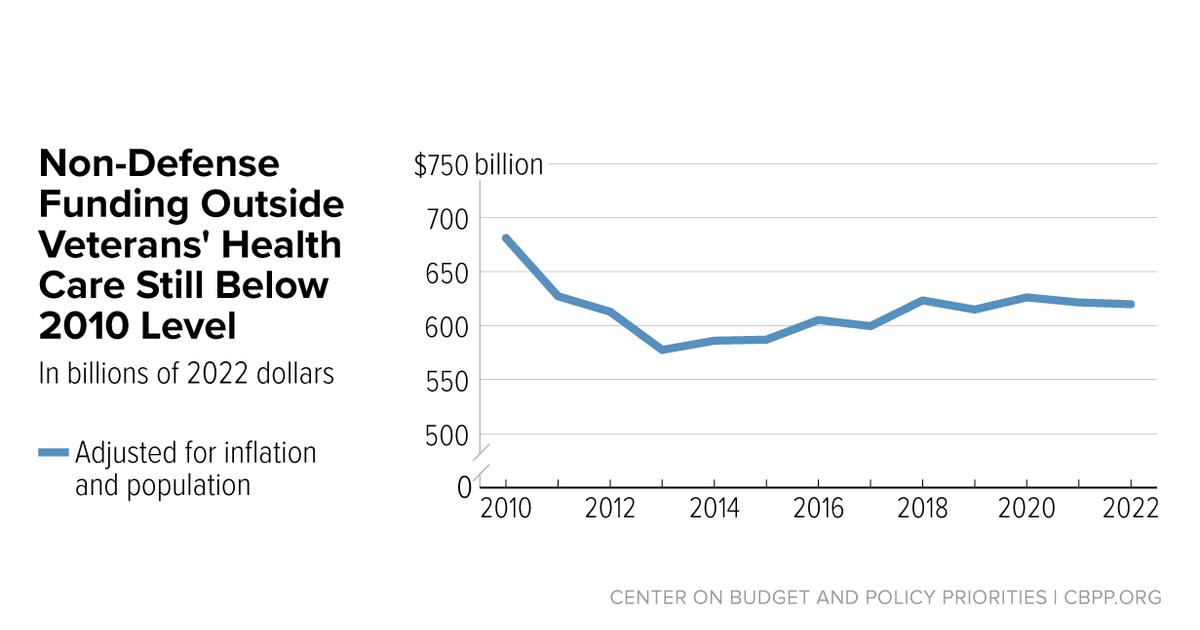

States With Temporary Budget Surpluses Should Invest In People Not Enact Permanent Tax Cuts Center On Budget And Policy Priorities

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

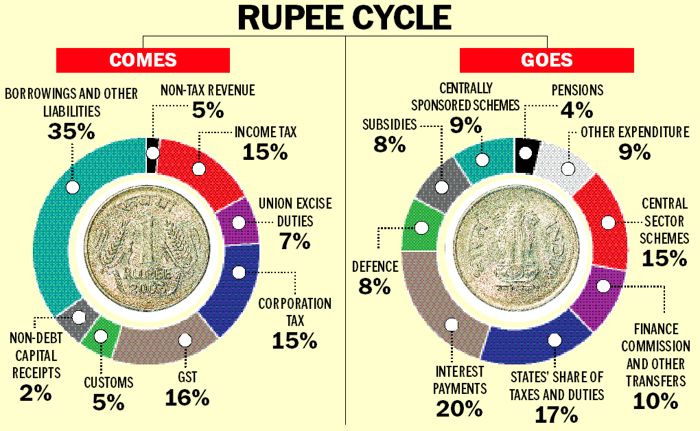

Union Budget 2022 23 Capex Push

2020 Tax And Rate Budgets City Of Hamilton Ontario Canada

Chapter 9 Tax Fairness And Effective Government Budget 2022

2022 Tax And Rate Budgets City Of Hamilton Ontario Canada

2019 Ontario Budget Chapter 1d

Tax Measures Supplementary Information Budget 2022

Budget 2022 23 Budgeting For Hard Times Ahead Newspaper Dawn Com

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Analysis Of President Biden S 2023 Budget Center On Budget And Policy Priorities

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Tax Measures Supplementary Information Budget 2022

Chapter 9 Tax Fairness And Effective Government Budget 2022

Budget 2022 Top Changes In Personal Tax

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World